Are you having trouble understanding Medicare and its many nuances? Rest assured that you’re not alone. It can take some time to understand and find the right coverage for you.

You are eligible to enroll in Medicare on the first day of the month you turn 65, unless you’ve already qualified due to a disability. If you don’t enroll when you’re initially eligible, you may have to pay a Part B late enrollment penalty. The next step is to choose the coverage you want. (You can change your elections at certain times of the year once you’ve enrolled).

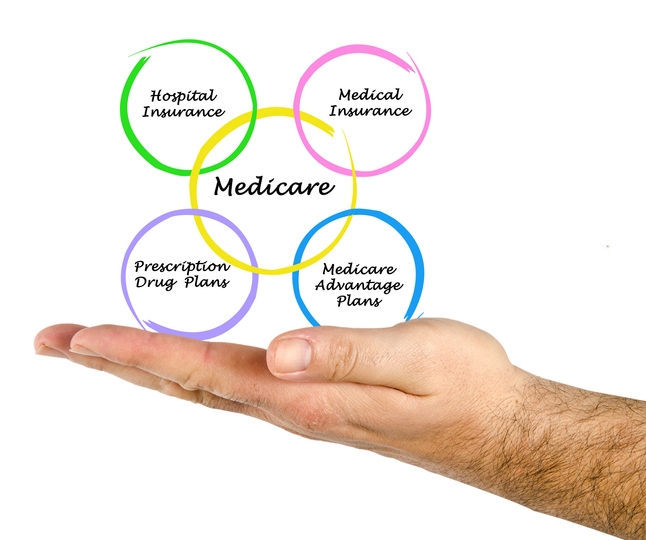

First, decide whether you want original Medicare (Parts A and/or B) or a Medicare Advantage Plan (HMO or PPO). If you elect to go with Medicare, you’ll enroll in Part A. This covers care in a hospital or skilled nursing facility, hospice, or home health care. Part B covers services or supplies needed to diagnose or treat a condition, as well as preventive services. Part B also covers things like ambulance services, certain medical equipment, and mental health services. Be sure to discuss your options with your an insurance professional.

Second, decide if you want to enroll in prescription drug coverage, also known as Medicare Part D. If so, you must select a Medicare Prescription Drug Plan. Locate a drug plan in your area.

Medicare Advantage includes a prescription drug plan. Some Medicare Advantage plans offer benefits like dental, vision, and the Silver Sneakers fitness program. But there are also downsides to this plan’s coverage that you should discuss with an insurance professional.

Next, decide if you want supplemental coverage. You can add a Medicare Supplemental policy, also known as Medigap, which can help pay some of the costs that Medicare does not cover. If you choose Medicare Advantage, you’re not eligible to buy or use supplemental coverage.

Once you enroll, it’s absolutely essential to stay on top of any changes in the coverage you have chosen. And again, we recommend discussing your specific needs with an insurance professional for the best results.

Article by guest contributor Sharon Wagner of Seniorfriendly.info